Stock Price Prediction

Time series forecasting in stock markets using Deep Learning

Predicting stock market trends has always been a challenging problem due to the complex and dynamic nature of financial markets. Stock prices are influenced by numerous factors such as economic indicators, investor sentiment, and company performance. While traditional methods use statistical models, machine learning techniques like LSTM have emerged as a powerful tool for handling sequential data.

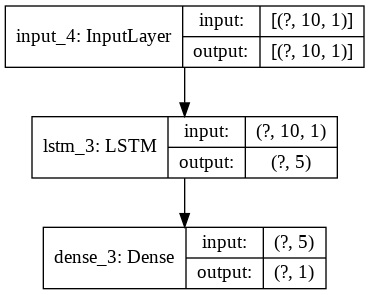

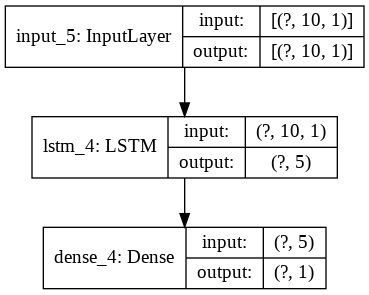

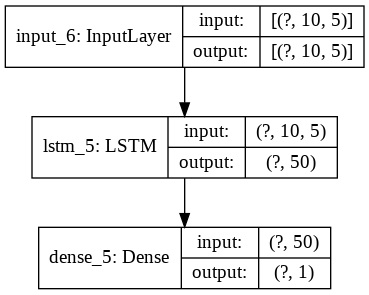

This research implements LSTM networks for three tasks:

- Predicting future stock prices based on historical data

- Forecasting stock returns, calculated as the percentage change in prices

- Classifying the directional movement (up or down) of stock prices using binary classification

The goal is to assess the performance of LSTMs in predicting stock-related variables and identify the challenges involved in financial sequence modeling.

Tensorflow

Neural Networks

RNN

LSTM

Adam optimizer

Classification

MSE

Pooling

Long Short-Term Memory (LSTM) networks are a specialized type of Recurrent Neural Network (RNN) designed to address the vanishing gradient problem. Unlike standard RNNs, which struggle to retain long-term dependencies in sequential data, LSTMs use a unique architecture that incorporates memory cells, enabling them to remember information over extended time steps.

The code for the project can be found : Here